The High Cost of False Savings

Risking America's Future for Pennies: How a 0.3% Budget Cut Could Destabilize a Nation

Summary

The DOGE budget cuts, which totaled $15.7 billion on March 10, pose serious risks and costs through reduced tax enforcement, financial instability, public health crises, environmental disasters, and a weakened global position. The costs of destabilization and insecurity would far exceed the 0.3% in annual savings—potentially leading to hundreds of billions or even trillions in economic damage.

The largest cuts come from major regulatory and enforcement bodies, meaning the DOGE cuts may cost more than they save. It’s similar to arguing that one should cut spending by not paying their mortgage or homeowner's insurance or save on healthcare by forgoing a yearly physical. The savings are meaningless without a review of return-on-investment and costs generated by the changes.

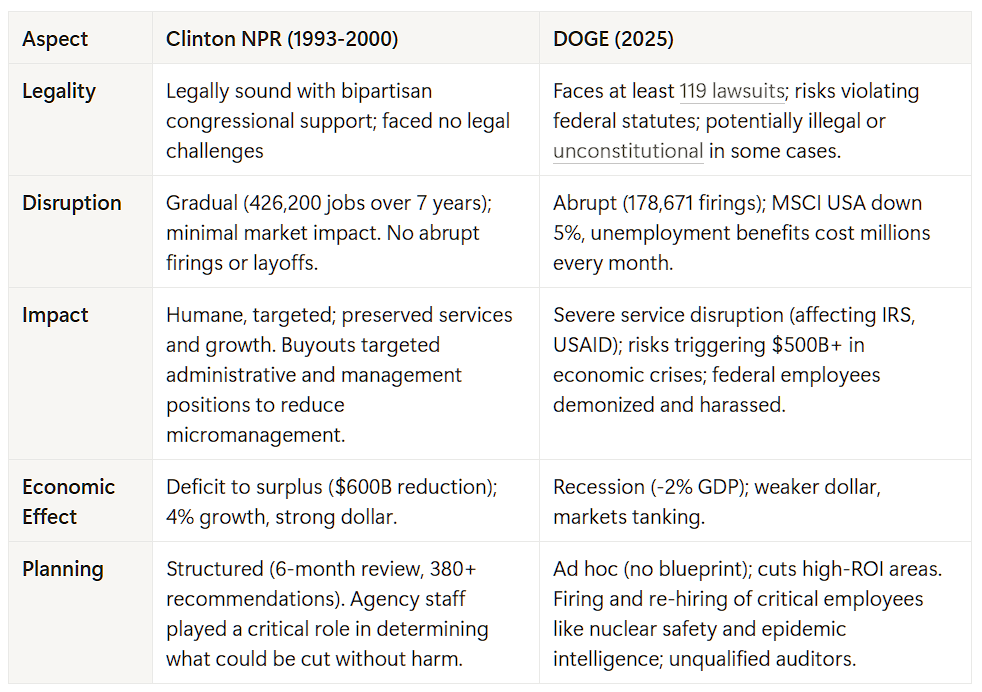

Unlike past government reductions that emphasized humane treatment and avoided economic harm, these reductions could trigger cascading economic and functional problems that far exceed any short-term savings, as detailed below.

Tax Enforcement Losses Could Exceed Savings: The IRS is losing $69 million in leased space, hindering audits and tax compliance enforcement. Tax enforcement typically generates far more revenue than it costs—for every $1 invested in IRS enforcement, the government collects $5 to $10 in recovered taxes. This ratio is even more favorable when the resources exist for the government to go after high-net-worth tax evasion. The IRS has collected over $1.3 billion in past-due taxes from high-income, high-wealth individuals since the fall of 2023. This represents a significant increase from the previous year's $38 million. The increase reflects increased investment. If reduced IRS capacity results in just a 1% drop in tax compliance, it could cost tens of billions in lost revenue—far exceeding the savings from these cuts.

Increased Costs from Fraud and Financial Instability: Cuts to SEC, CFPB, and DOJ financial oversight could lead to more corporate fraud, market manipulation, and financial crises. The 2008 financial crisis, which resulted from weak regulation, ultimately cost the U.S. government over $500 billion in bailouts and stimulus spending. The crisis cost every American an estimated $70,000 in lifetime present-value income loss. A rise in financial crimes or consumer fraud could force costly emergency interventions that dwarf the initial $15.7 billion in savings.

Higher Public Health and Disaster Costs: FDA, CDC, and HHS cuts could delay responses to disease outbreaks, leading to higher long-term healthcare costs. Environmental agency reductions mean fewer inspections and weaker disaster preparedness, increasing costs from wildfires, hurricanes, and pollution-related health crises. The 2020 COVID-19 pandemic cost the U.S. government over $5 trillion in emergency spending—highlighting how underfunding public health and crisis response can have devastating economic consequences.

Weakening U.S. Global Influence Leads to Security Risks and Higher Defense Costs: The proposed USAID cuts ($9.3 billion) would likely trigger increased regional instability abroad, forcing greater military spending and diplomatic interventions. The impact would be significant—for example, USAID programs have reduced migration in targeted communities. Border states like Arizona benefit from research in border security and immigration. Critically, China and Russia will step in to fill whatever void the U.S. leaves. Where Russia expands, it drives mass migration intentionally and props up organized crime, which further drives people from their homes.

Historical Precedents Offer Little Encouragement: The 2013 Sequestration cuts led to economic slowdowns, reduced GDP growth, and delayed government services. Many cuts were later reversed because they were causing more harm than good. UK Austerity Measures (2010s) led to increased poverty, lower productivity, and economic stagnation, forcing the government to spend more on social welfare and economic stimulus later. Early effects of these slash-and-burn changes have not been economically encouraging.

Top Agencies for Lease Termination

Top Agencies for Contract Termination

Subscribers have access to a more in-depth analysis of the data and citations.

Keep reading with a 7-day free trial

Subscribe to InfoEpi Lab to keep reading this post and get 7 days of free access to the full post archives.